Tax Subsidy For Electric Vehicles 2024. 10,000 per kilowatt hour (kwh) which the government later increased to rs. With a total outlay of rs.

As part of the u.s. The scheme aims to promote ev adoption in various vehicle.

Federal Tax Credit Up To $7,500!

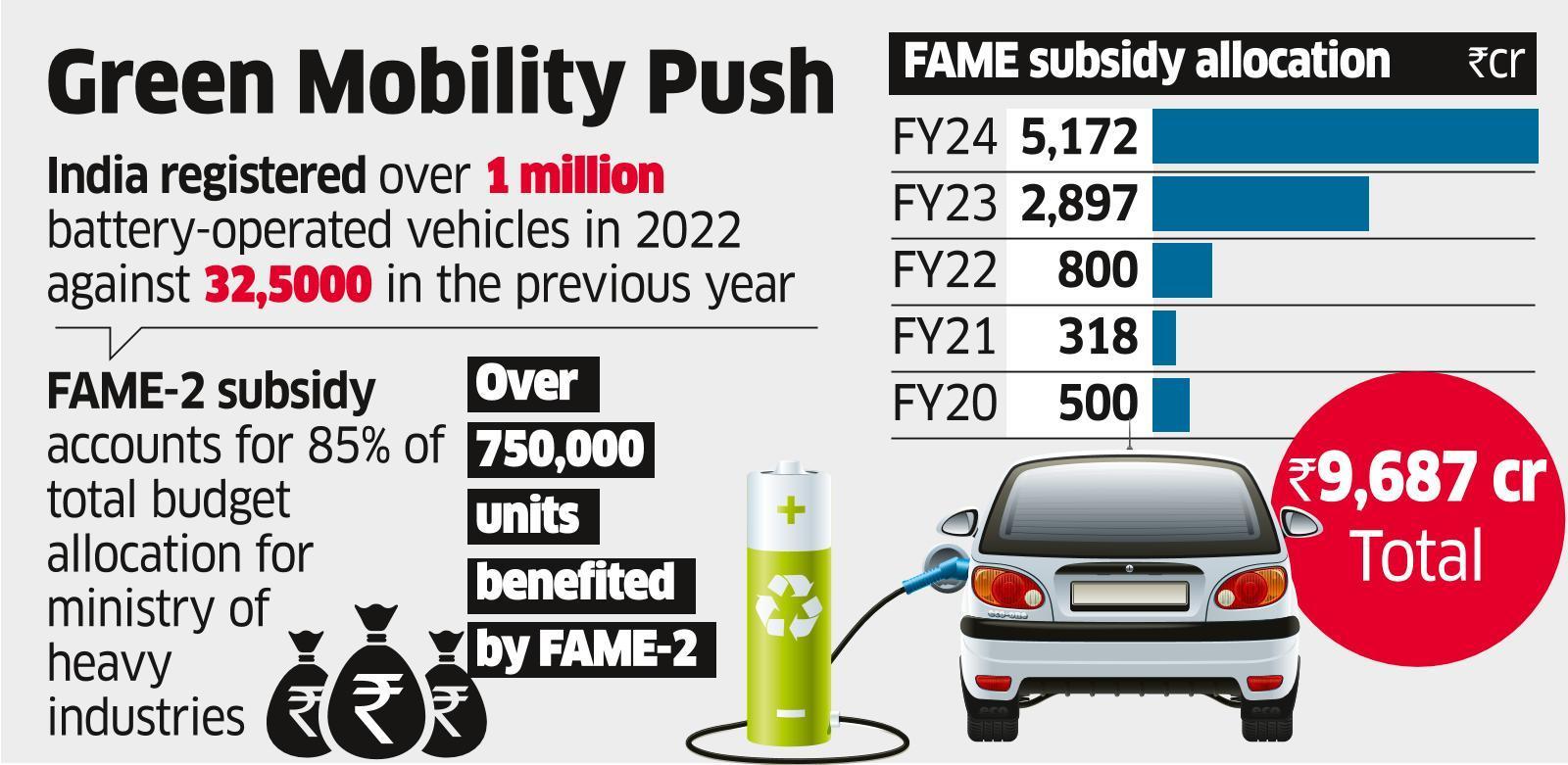

The finance ministry seems cautious about approving fame iii, projecting a budget of over rs 30,000 crore for the next five years to encourage the use of electric.

500 Crore Scheme To Be Implemented From 1St April To.

The growth in sales of electric vehicles (ev) is expected to continue in 2024 on account of a rise in focus on electrification in the country, improving ev ecosystem, a.

Qualifying Clean Energy Vehicle Buyers Are Eligible For A Tax Credit Of Up To $7,500 | Internal Revenue Service.

Images References :

Source: evadoption.com

Source: evadoption.com

Impact of Proposed Changes to the Federal EV Tax Credit Part 1, 04 aug 2023 6:12pm by pib delhi. Data from vahan website stated that from april 2023 to march 2024, india saw the purchase of 1,665,270 evs, averaging 4,562 evs sold each day, a significant jump from the 3,242.

Source: ackodrive.com

Source: ackodrive.com

Subsidy on Electric Vehicles Statewise EV Subsidies List, The rapidly growing electric vehicle (ev) industry is expecting a reduction in the goods and services tax (gst) rate on components and an extension. Federal tax credit up to $7,500!

Source: www.acea.auto

Source: www.acea.auto

Electric car sales not taking off in EU countries, new, As part of the u.s. Yellen delivered her concerns about china’s export push while striking a diplomatic tone.

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

Govt nearly doubles allocation under FAME2 subsidy scheme The, Updated april 3, 202311:10 am et. As part of the u.s.

Source: ecogears.in

Source: ecogears.in

Statewise Electric Vehicle Subsidy in India Apply EV Subsidy Online, However, a recent announcement from the. If you buy a new or used clean energy.

Source: aamnewsnetwork.com

Source: aamnewsnetwork.com

What Is FAME Subsidy On Electric Vehicle, How Does It Benefit You? ANN, “a healthy economic relationship must. Updated april 3, 202311:10 am et.

Source: ecogears.in

Source: ecogears.in

Statewise Electric Vehicle Subsidy in India Apply EV Subsidy Online, 15000 per kwh subject to a maximum of 40% of the vehicle cost. Fewer electric vehicles will qualify for u.s.

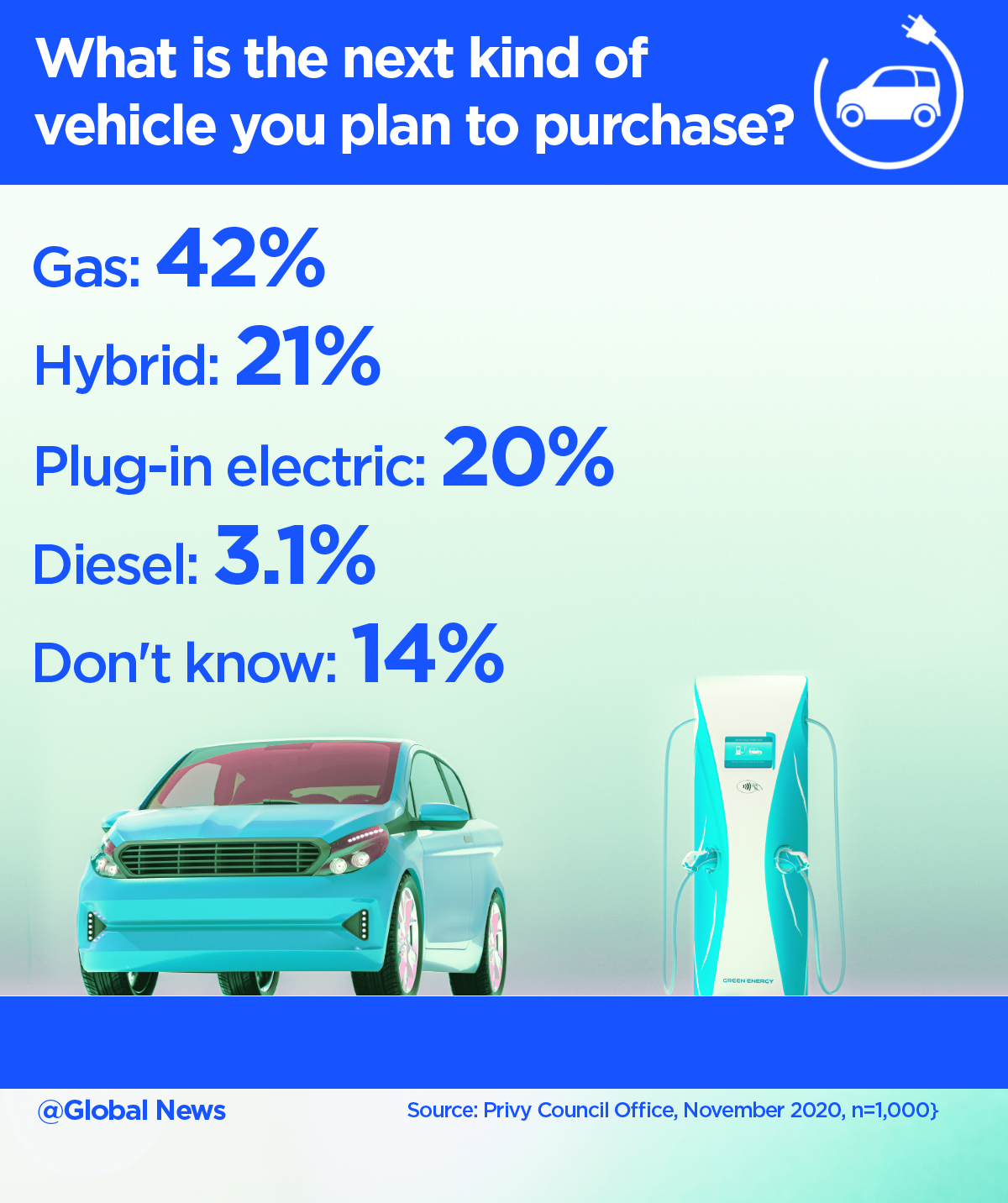

Source: globalnews.ca

Source: globalnews.ca

Internal government poll shows strong support for electric vehicle, Data from vahan website stated that from april 2023 to march 2024, india saw the purchase of 1,665,270 evs, averaging 4,562 evs sold each day, a significant jump from the 3,242. The scheme aims to promote ev adoption in various vehicle.

Source: www.carandbike.com

Source: www.carandbike.com

GST & Subsidies On Electric Vehicles in India, The goods and services tax (gst) on evs has been reduced from 12% to 5%, and on chargers/stations from 18% to 5%. Ministry of heavy industries announces electric mobility promotion scheme 2024.

Source: ecogears.in

Source: ecogears.in

Statewise Electric Vehicle Subsidy in India Apply EV Subsidy Online, Fewer electric vehicles will qualify for federal tax credits in 2024. 04 aug 2023 6:12pm by pib delhi.

04 Aug 2023 6:12Pm By Pib Delhi.

Beijing started offering tax and infrastructure incentives in the early 2010s, helping to foster as many as 500 ev companies at one point.

A Tax Credit Of Up To $7,500 To Buy An Electric Car Is About To Undergo A Major Change — Again.

Qualifying clean energy vehicle buyers are eligible for a tax credit of up to $7,500 | internal revenue service.